Did you know that over 60% of Pakistanis are not aware of all their available health coverage options? This hidden reality affects millions and could directly impact your well-being.

In a world where health concerns top global agendas, understanding your health insurance choices in Pakistan is crucial. With ever-evolving policies and coverage options, now more than ever is the time to delve deep.

Despite popular belief, many Pakistanis think they have no choice but to pay out-of-pocket for medical emergencies. However, this couldn't be further from the truth! Government initiatives and private insurers alike have expanded their networks enormously. But that's not even the wildest part…

Imagine discovering a well-kept secret: there are specific local programs that provide comprehensive coverage for a fraction of the cost. These hidden gems can save families big bucks. But how can you access them? What happens next shocked even the experts…

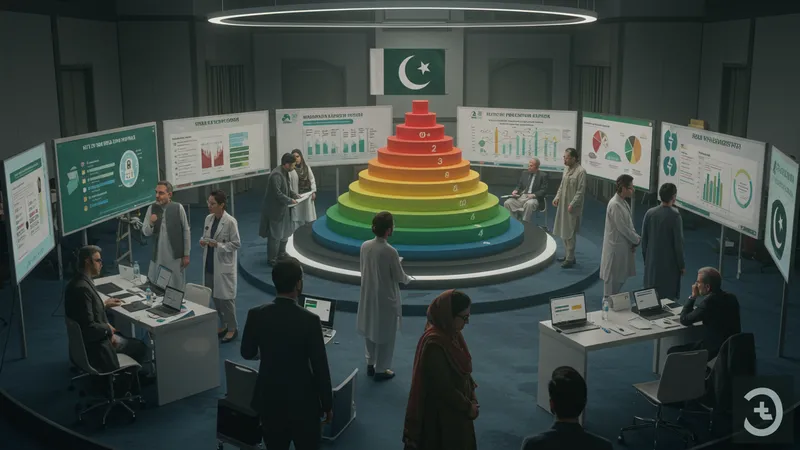

When we talk about government health coverage in Pakistan, many instantly think of burdensome paperwork or limited services. But the reality is starkly different. Programs like the Sehat Sahulat Program offer a groundbreaking relief not just for low-income families but also cater to a wider audience thanks to recent expansions. With a maximum annual coverage up to PKR 720,000 for medical treatments, the benefits are undeniably significant. But there’s one more twist…

What many might not realize is the flexibility introduced in these plans. Recently, several provincial governments have standardized procedures to make health coverage more accessible across diverse regions. This reform means fewer delays and swift access to medical care without hefty payments. Still, little is known about why these changes were made. Could it be due to hidden pressures or international benchmarks? The mystery deepens…

Additionally, applicants to government health plans often underutilize features like preventive care visits and medication subsidies. Simply put, these plans are treasure chests often left unopened. Surprisingly few take full advantage of what's available, leading experts to question: Why does this gap in awareness persist, and what's being done to bridge it?

The underlying reasons for this discrepancy might just change the entire perspective on health coverage in Pakistan. The journey through Pakistan's health landscape is richer and more diverse than most would ever suspect. Keep reading to uncover revolutionary insights…

While some may turn a wary eye toward private health insurers, there's no denying their surging popularity in Pakistan. Citing flexibility and enhanced customer service, urban families are leaning toward these options more than ever before. Companies like Allianz and Jubilee Insurance are constantly innovating. Allianz’s recent introduction of tailored packages for common chronic diseases is particularly eye-catching. But the real reason for this trend might surprise many…

The influx of international companies into the Pakistani market is reshaping healthcare delivery. This strategic entry is about more than just profitability; it involves tapping into a market ripe for transformation. Foreign investments in private health insurance not only bring diversified plans but also introduce global standards that lure consumers seeking reliable services. Yet there’s a side rarely discussed, and its implications might change how we view health insurance.

Another compelling factor is the cutting-edge technology employed by private insurers. Real-time claims processing and AI-driven customer service are no longer just fantasies but tangible benefits. These advancements significantly reduce the administrative hassle, which means consumers spend less time worrying about paperwork and more time focusing on their health. But what happens when technology fails? A real case could leave you speechless.

It's essential to consider how private plans are catering to niche markets. For instance, specialized insurance for employees in hazardous jobs has become increasingly popular. But what are companies omitting from these appealing packages? The answers could redefine your health coverage decisions. Let’s delve deeper into these existential questions…

Often branded as the ultimate shield against medical expenses, 'comprehensive' health plans are not always what they claim to be. Skeptical consumers are digging deeper and realizing the hidden caveats. These plans might exclude vital procedures or medical conditions that can render them ineffective when truly needed. But why do they persist? There’s a story here no one expects…

Insurance jargon can often conceal more than it reveals. Terms like "pre-existing conditions" or "network restrictions" sound innocuous but can surprise holders when claims are made. Internal reviews often indicate discrepancies between what’s promised versus what’s delivered. Some face regulatory scrutiny, while others undergo public outrage. The transparency issue is a ticking time bomb awaiting detonation.

Moreover, policyholders may not realize the limits of their coverage until it’s too late. Imagine being hospitalized and learning certain facilities or treatments aren't included. Frustration mounts and financial stress escalates, leading many to regret their initial choice. What if this knowledge was more accessible? This oversight could lead to reforms that modify the whole sector's approach.

If comprehensive plans aren’t all they’re cracked up to be, what’s the alternative? As disillusionment grows, more look into customizable plans or hybrid models. These emerging options may just offer the best of both worlds, but who dares to challenge the status quo? Keep reading to see the unexpected strategies surfacing in the landscape…

One of the most exciting developments in the health insurance sector is the advent of hybrid plans. These innovative models blend features from both public and private policies, providing unparalleled benefits. By offering a mixture of basic essential coverage and flexible add-ons, they cater to a broadening audience. The implications of hybrid plans could redefine the entire industry.

Initially considered an experimental approach, hybrid insurance models have exploded in popularity due to their adaptability. Users customize their healthcare needs and budgets, leading to a tailored experience that truly responds to individual requirements. The notion of 'one size fits all' is clearly on its last legs. But what is motivating insurers to innovate? The answer may lie in unseen industry pressures.

One significant advantage of hybrid plans is their cost-effectiveness. They merge the affordable aspects of government programs with the flexibility and innovation of private insurers, often resulting in reduced premiums. However, questions remain about the long-term viability of this model. Can these plans sustain competitive pricing without compromising quality?

The evolution of hybrid plans mirrors the dynamic shifts in consumer preferences. As society demands more adaptable and transparent options, insurers must pivot or risk obsolescence. This growing awareness among consumers indicates a necessary industry-wide introspection that might just revolutionize health insurance as we know it. As we delve further, we uncover layers that challenge even seasoned analysts…

Digital health platforms are changing the rules of the game in the insurance sector. With apps offering everything from virtual consultations to digital health records management, these tools are fast becoming indispensable. Their integration with insurance services promises to redefine consumer expectations. But could these advancements herald a new era in health coverage?

Consider platforms like Oladoc and Marham, which bridge gaps between patients and healthcare providers with just a few clicks. These user-friendly apps are creating new synergies within the insurance sector. The addition of health tracking and digital claims processing significantly enhances both consumer experience and service delivery. But what might happen when technology supersedes traditional methods?

There’s a constant quest for accuracy, and data-driven solutions offer a remarkable advantage. By monitoring health metrics, these platforms can tailor insurance options that reflect actual user needs. This introduces a personalized approach previously missing in the standard models. However, as digital footprints grow, issues of data privacy and security arise. Is the trade-off worth it for more personalized care?

The integration of digital health with insurance is not just a transformation but an evolution. As more consumers prioritize convenience and precision, insurers who invest in digital transformation will likely reap the rewards. It's a brave new world, but not without its pitfalls. The question is, will the industry adapt swiftly enough to these relentless technological shifts? The answers lie just ahead…

Employer-sponsored health coverage is far from the static benefit it once was. As companies struggle with rising costs and employee demands for enhanced benefits, this scenario is evolving rapidly. This benefits package is morphing into something both fascinating and revolutionary.

Employers are now moving beyond standard policies, incorporating wellness initiatives and mental health incentives to attract top talent. Flexibility in selecting healthcare needs is becoming a significant lure. This evolution is a response to not only competitive markets but also awareness of comprehensive well-being as a critical factor in job satisfaction.

Moreover, companies are starting to expand their health coverage to include dependents, reflecting changing societal norms and demands. This modifies the traditional model, providing a safety net broader than what was considered possible a few years ago. However, juggling costs and comprehensive coverage presents its own set of challenges.

The shifting landscape suggests that employer-sponsored health insurance is on the brink of a significant overhaul. As companies seek to balance costs with unparalleled care benefits, major policy shifts might just redefine what employees can expect. Will this trend trigger a domino effect across the industry? Only time will tell as this dynamic situation unfolds…

Living as an expat in Pakistan offers a unique blend of cultural richness and professional opportunities, but when it comes to health insurance, the landscape can be unexpectedly challenging. Many expatriates find their options limited compared to their local counterparts, resulting in a sometimes precarious balance between adequate coverage and affordable cost.

Global health insurers often provide enticing packages tailored specifically for expatriates, offering features like international coverage and emergency evacuation. However, these come at a premium, which may not always align with every expat's budget. How do you navigate this without compromising on essential healthcare needs?

One common misconception among expats is that local insurance won't cater efficiently to their needs. However, some local providers offer plans that integrate with global networks, presenting a viable alternative that combines the best of both worlds. Yet, awareness about these offerings remains surprisingly low.

For expatriates, selecting a health insurance plan involves more than just examining cost and coverage. Cultural factors and linguistic challenges play a critical role in decision-making. But what’s the secret to finding a plan that meets diverse needs without sacrificing quality or going over budget? The path to discovering these answers might alter your approach entirely…

There's a little-discussed connection between health coverage and economic stability in Pakistan, a link that might just surprise you. As more people gain insurance, the financial burden of unexpected medical expenses decreases, providing an economic stability that resonates across entire communities.

Consider the ripple effects: families with adequate health coverage tend to experience fewer financial strains, leading to better financial decision-making. When medical emergencies arise, insurance prevents the drain on personal savings, allowing for more sustained economic contributions. It's an interconnected system with far-reaching impacts.

For the weak economic structures in many regions, health coverage can provide a much-needed safety net. Local economies benefit as people's spending power improves, creating a positive feedback loop. But there’s a side rarely spoken of — the strain on governmental resources when disguised costs emerge without insurance support.

Understanding this dynamic isn't just about recognizing policies but acknowledging a broader societal change. As awareness grows, so too does the realization that health coverage isn’t merely a personal need but a foundational pillar supporting economic growth. What changes lie ahead in this intricate dance between health and wealth? Keep reading, and all will be revealed…

Micro-insurance might not be on everyone’s radar, but in rural Pakistan, it's quietly revolutionizing healthcare access. Designed for low-income individuals and families, these tailored insurance solutions are changing perceptions and realities. Could this be the answer to widespread healthcare inaccessibility?

These smaller, often community-driven models provide affordable coverage with a focus on essential health services like maternal care and common illnesses. With premiums aligned to suit rural economies, these plans are bringing insurance to those who once deemed it unattainable. But how do they overcome the persistent challenges faced in rural areas?

Micro-insurance capitalizes on the idea of collective risk, distributing costs among numerous participants, which keeps premiums low and accessible. This system not only benefits individuals but also strengthens community resilience, equipping families to tackle health emergencies without financial devastation. However, challenges around awareness and trust must still be navigated.

As micro-insurance models mature, their potential to fill the gaps in universal healthcare in Pakistan grows stronger. These plans symbolize a shift towards inclusive health coverage, creating a future marked by greater equity and access. Can these innovative strategies bridge the final gaps in healthcare access across the country? With each unfolding page, the possibilities expand…

Misconceptions about health coverage remain widespread, even as awareness increases. Many individuals harbor outdated beliefs that can lead to poor planning and financial vulnerability. Correcting these misconceptions is vital for both coverage seekers and the broader insurance industry in Pakistan.

One pervasive myth is that health insurance always comes with hefty upfront costs, deterring many from exploring their options. However, numerous affordable plans exist that cater specifically to varied income levels and needs. But what contributes to this falsehood's persistence?

Another common fallacy is the belief that all health coverage plans are essentially the same. This couldn't be further from the truth, as plans vary significantly in terms of benefits, premiums, and exclusions. Educating the public on reading the fine print provides leverage to choose more advantageous packages.

Dispelling these myths requires a collaborative effort, involving policy advocates, insurers, and government schemes. As understanding expands, so too does the ability of consumers to make informed decisions. Could this transformation in public perception foster a more equitable insurance system? The exploration continues, revealing deep-seated truths…

In the world of health insurance, the term 'coverage gaps' often surfaces, but many overlook its profound implications. These gaps can lead to unexpected expenses and limited access to essential health services, drastically affecting both health outcomes and financial stability.

Gaps can arise from various factors including policy limits, exclusions, or waiting periods. Often underestimated, these can catch policyholders off guard during critical times, resulting in emotional stress and financial strain. But what often prevents consumers from recognizing these before crises hit?

Understanding the nuances of a health policy, including its limits and exclusions, is crucial in identifying potential gaps. This involves a keen eye in scrutinizing terms before committing. However, the complexity of language and the abundance of clauses might deter many from truly comprehending what they're signing up for.

Ultimately, addressing coverage gaps could lead to a more robust health insurance ethos in Pakistan. As the centrality of transparency and education grows, so too does the potential for optimizing plans that meet the diverse needs of consumers. Yet, how will the industry respond to this pressing issue? The narrative continues to unfold…

As dynamic discussions around healthcare evolve, policy reforms stand at the forefront of potential positive change in Pakistan. Reforms could streamline coverage options, making them more accessible, efficient, and versatile for everyone. But what groundbreaking changes might they entail?

There's ongoing debate about introducing tiered healthcare subsidies, aligning benefits more closely with economic capabilities. Such redistributions could significantly lower the barriers for accessing quality care, ensuring broader inclusivity. However, achieving this balance involves meticulous planning and stakeholder collaboration.

Policy reform advocates argue that simplifying the claims process and improving transparency in policy terms could enhance consumer trust. Bringing policies closer to consumer understanding may lead to increased participation and satisfaction. The challenge stems from aligning diverse insurance interests while meeting end-user expectations.

Overall, these reforms present a unique opportunity to not just refine but redefine how health coverage is conceptualized and implemented in Pakistan. Will policymakers rise to the occasion and usher in a new era of healthcare accessibility? Only future developments will fully reveal the outcomes of these transformative attempts…

Forecasting the future of health coverage in Pakistan is both an art and a science. Experts predict that the sector is poised for significant innovation, driven by technology, policy reforms, and evolving consumer expectations. Yet, what exactly lies ahead might defy even the most seasoned predictions.

Analysts posit that digital integration will reach unprecedented levels, becoming the bedrock of the insurance industry. Virtual health networks and personalized AI-driven plans are speculated to shift the landscape radically. But can we fully trust technology to manage such a deeply human aspect of life?

The potential for cross-border collaborations to refine and enhance insurance offerings is another prospect gaining traction. Global partnerships might lead to more robust and comprehensive coverage solutions, simultaneously driving down costs and improving access. The conceivable challenges are manifold and complex, requiring nimble strategies and visionary leadership.

Ultimately, the future of health coverage in Pakistan promises a plethora of opportunities and challenges alike. The decisions made today will set the stage for impending transformations that could define the nation's healthcare narrative. Yet what surprises might tomorrow hold for both consumers and industry leaders? The next chapter anticipates…

This deep dive into health coverage choices in Pakistan uncovers more than just policies; it's about understanding a paradigm primed for reform and innovation. As knowledge grows, making informed decisions could lead to substantial shifts in both personal and societal spheres. Now is the time to explore, engage, and evolve your understanding and approach to health insurance. Bookmark this article, share it with those who need it, and contribute to a well-informed society ready to embrace the future. What's next could just redefine the way we think about health coverage forever.