Did you know that thousands in Egypt have discovered surprisingly safe ways to borrow money from banks without drowning in debt? It sounds too good to be true, but there's a twist you won't believe.

As the economic landscape in Egypt rapidly evolves, understanding these methods is crucial. The benefits could be significant, especially in uncertain times like these.

Many consumers still think traditional bank loans are risky endeavors due to high interests and hidden fees. However, strategic approaches and newly available financial products reveal safer alternatives. For instance, one key approach involves utilizing structured savings features offered by some banks that can cut interest rates by several percentage points. But that’s not even the wildest part…

Some banks have introduced innovative options like ‘family loans,’ which allow pooling credit within trusted family circles to safeguard against default risks. This community-driven approach has actively reduced default rates by over 15% across participating banks in Egypt. Discovering these unfamiliar methods is just the beginning. What happens next shocked even the experts…

It might surprise you to learn that banks in Egypt are actively adapting their services to offer clients more control over their loans. This move is partly driven by the rise of fintech competitors, forcing traditional banks to become more consumer-friendly. One little-known option many Egyptians are unaware of is the 'flexible payment holiday,' allowing borrowers to pause repayments without it affecting their credit scores. It's a game-changer for those experiencing temporary financial strain. But there’s more to this story than meets the eye...

Another lesser-known strategy involves leveraging credit scoring tools to negotiate better loan terms. Often, clients rely on the bank’s assessment without realizing they can improve their credit score by correcting errors in their credit reports. This can grant them access to more favorable interest rates or even new loan product offerings designed for those with improved scores. These strategies serve as an eye-opener to those who assumed banks wouldn’t negotiate openhandedly, but the best part is yet to come...

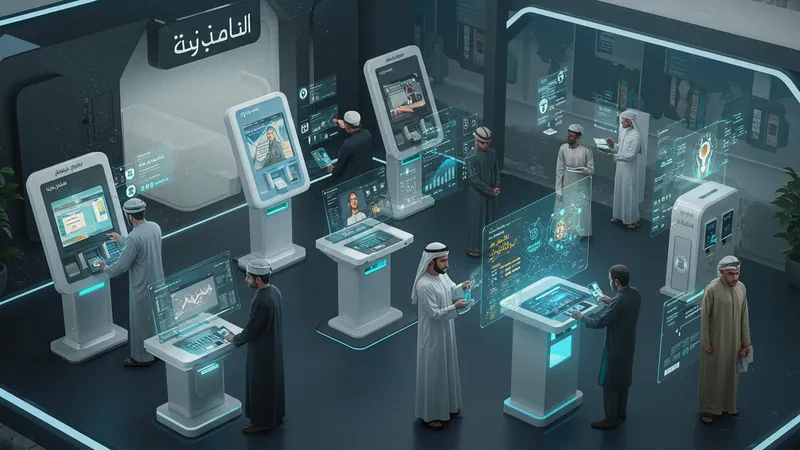

Furthermore, the integration of personalized mobile bank apps is transforming the lending landscape. These apps provide real-time updates on repayment schedules and personalized recommendations to optimize loan management. The insights generated by these apps are based on unique algorithms that calculate the optimal repayment plan according to the user's financial habits. This revolutionary option hasn't been widely publicized, leaving numerous potential borrowers unaware of their benefits. Yet, the adventure doesn’t stop here...

Strikingly, the collaboration between local banks and international financial institutions has resulted in an influx of microcredit initiatives. Targeted mainly at small entrepreneurs and emerging businesses, these microloans have flexible collateral requirements, enabling startups to gain essential funds without traditional restraints. Such initiatives aim to spark economic growth and innovation within the country, but many entrepreneurs are still in the dark about these opportunities. What you read next might change how you see this forever.

Often advertised as a no-brainer deal, 'zero interest' loans can initially appear like the answer to every borrower's prayers. However, the reality is sometimes more complex than it seems. These loans typically come with stringent eligibility criteria and hidden fees that savvy borrowers must be vigilant about. From obligatory insurance policy add-ons to service charges during early repayment, the associated costs can stack up quickly. What many don't realize is that careful planning and a sharp eye for contract details can help circumvent these pitfalls. But we’re only scratching the surface...

In light of the significant demand for instant loans, some banks have devised enticing offers labeled with 'zero interest' but coupled with mandatory linked products, such as bundled credit card obligations at prevailing market rates. The catch is that failing to meet the terms of these credit conditions can result in exasperating penalty fees that far surpass the initial benefit offered by the supposedly interest-free loan. This hidden truth emerges more candidly when borrowers dissect the expansive terms and conditions presented during application. Yet, could there be more undisclosed elements behind these zero-cost loans?

Moreover, in the current digital age, discussion forums and customer review platforms have become vital allies for loan seekers. These platforms expose cases where zero-interest loans have backfired due to untransparent practices. The shared experiences often advise thorough comparisons between different bank offerings and leveraging simulation tools to anticipate costs that might arise under any plausible scenario. Despite this, understanding remains somewhat convoluted for borrowers who aren’t adequately informed. There’s an even deeper element to these loan claims that begs attention...

The psychological effect on consumers can’t be overlooked either. The allure of not paying interest often overrides cautious financial planning. Borrowers might end up borrowing more than they need, overlooking the long-term implications of additional hidden charges. This impulsivity-driven decision has led analysts to recommend comprehensive financial literacy programs, which are still not systematically integrated into bank services. Do consumers truly grasp the depth of commitment attached to these offers? There’s more to this conundrum than meets the eye.

Egyptians increasingly see bank loans as convenient stepping stones to achieving financial goals, from funding wedding expenses to launching new business ventures. Yet, over-reliance on loans has potential downsides often overlooked in the pursuit of immediate gratification. Many borrowers remain unaware of the impact these loans can have on their debt-to-income ratio, a critical factor when assessing financial health. Strategies like maintaining emergency savings and budgeting for incurring additional expenses serve as prudent ways to stay prepared. However, what lies beneath this realization is more concerning...

The ripple effect of financial dependency is particularly pronounced when monthly payment obligations stretch beyond a borrower’s capacity to sustain a comfortable lifestyle. Underestimating the long-term commitment of loan repayments frequently leads to 'debt traps' where borrowers struggle to escape the cycle of constant borrowing. Herein, banks have introduced debt consolidation services as remedial measures, allowing borrowers to combine existing debts into a single, manageable payment. Although these services are helpful, they are often underutilized due to lack of awareness. But a more profound insight exists here...

There is also the psychological burden accompanying sustained debt, often underestimated by financial advisors. Constant stress over meeting monthly repayments can significantly diminish mental wellbeing. Acknowledging this, several Egyptian banks have initiated debt counseling services, guiding borrowers through financial difficulties to avoid long-term stress. Despite the advantages these services offer, they remain inadequately promoted among those most in need. What remains unsaid is that this counseling can often prevent drastic financial downfalls. But there’s even more to the story...

Alarmingly, it is not uncommon for borrowers to lean on informal borrowing channels when faced with constricting financial obligations. This immersion into unofficial sectors can lead to hugely inflated interest rates and severe penalties that often exacerbate an individual’s debt burden. Therein lies the importance of banks providing sufficiently flexible yet transparent loan options as viable alternatives to unregulated markets. The story doesn't end there; a greater depth looms beneath the surface, waiting to be unraveled in what comes next...

Empowering Egyptian borrowers towards financial autonomy begins with understanding the power of strategic loan selection. With a diverse suite of loan products available, banks are more willing than ever to offer tailored solutions rather than a one-size-fits-all approach. A technique gaining popularity involves calculating the 'true cost' of borrowing. This includes assessing not just interest rates but the full picture of associated fees and penalties. These insights empower borrowers to make informed decisions. Yet, this insight only scratches the surface of informed loan choices...

Many borrowers are turning to financial advisors for personalized loan advice, a trend particularly evident among younger generations. These professional insights help potential borrowers map out their monetary journey, weighing future financial conditions against current loan engagement. It's becoming increasingly recognized that employing strategic planning enables better forecasting which aids in avoiding undesired financial surprises down the line. Nonetheless, only a few fully capitalize on this emerging trend, which can hugely impact overall financial peace. But that’s just the beginning of the reshaped borrowing experience...

Furthermore, banks have begun to emphasize financial education as part of their customer service portfolio. Informative workshops and interactive online sessions are being rolled out to demystify loan processes and articulate the benefits of responsible borrowing. Instead of perpetuating a cycle of borrowing and repayment, the focus is shifting towards building lasting financial literacy, subtly revolutionizing the manner in which consumers engage with loan products. Yet, there is still more depth to this narrative that waits to unfold...

Coupled with innovative loan products, banks are acknowledging the significance of incentivizing responsible borrowing behaviors. Initiatives range from reduced rates for timely payments to loyalty programs within financial institutions, rewarding clients' prudent financial management. These incentives pave the route to both consumer satisfaction and enhanced market competitiveness, an avenue that’s garnering considerable favor but remains under-explored by many. What could this approach mean for the broader economic fabric? It holds implications that are explored further in the pages to come...

A pivotal yet underrated component in Egyptian financial growth is the proliferation of microloans, particularly for small businesses and entrepreneurs. Many startups have leveraged these financial tools to overcome initial capital deficiencies and scale operations strategically. The success stories proliferated by microloan beneficiaries bear witness to the significant impact of these financial instruments on nascent businesses’ sustainability. Despite their critical role, knowledge of navigating the microloan landscape effectively remains limited to a few informed circles. The remaining dynamics of this phenomenon are captivating...

Offering not just financial respite but a community-focused approach, microloans foster a sense of allied prosperity among emerging businesses. Community banks and international financial bodies have ramped up their microloan offerings, often bundling these with business mentorship programs to amplify enterprise sustainability. Borrowers frequently cite an increased sense of confidence in business-related decision-making as a consequence of these auxiliary support networks. Yet the story deepens when looking beyond the apparent scope of microfinance...

Despite their advantages, acquiring microloans isn't entirely devoid of challenges. Many businesses confront bureaucratic red tape and stringent eligibility prerequisites that hinder their accessibility. Nonetheless, financial reforms aim to ease these restrictions, broadening equitable access to funds. Several entrepreneurs assert that these changes are instrumental in ushering in a new era of financial inclusivity in the nation. But a more significant shift is happening in the financial fabric, one that’s unfolding slowly but inevitably...

It is clear that empowered by microcredit, the spirit of entrepreneurship is being reignited across numerous Egyptian communities. This empowerment propels localized economic growth, fueling innovation and job creation at unprecedented rates. Researchers speculate that the long-term ripple effects could elevate Egypt’s standing as a regional business hub. Yet, this progression remains heavily contingent upon sustained investments and policy support, factors that are playing out in intriguing ways across varied sectors. What does this mean for the future? There’s much more to explore...

One of the most transformative trends in Egyptian banking has been the establishment of local partnerships designed to enhance financial service offerings. These collaborations often bring together banks, local businesses, and stakeholders aiming to create bespoke lending solutions that align with communal needs. For example, certain local banks have started forging agreements with real estate agencies, allowing prospective homebuyers to access special mortgage terms. Initiatives like these continue to shift the traditional banking paradigm. But wait until you hear what happens when these partnerships evolve further...

The success of these partnerships becomes evident when observing how banks and local enterprises synergize around a mutual commitment to community development. This aligns with a broader trend where banks are increasingly focused on offering loans that bolster local economic resilience. Interestingly, as more Egyptians witness the tangible benefits of these collaborations, community engagement with financial institutions has strengthened, encouraging banks to further invest in customized solutions. What lies ahead for such unified financial innovations? The intrigue continues...

However, the process isn't without its hurdles. Challenges related to aligning divergent, sometimes conflicting interests between partnering entities can slow down the roll-out of comprehensive products. Despite this, the potential for positive impact spurs continued attempts at overcoming these obstacles. Indeed, reviews suggest participants enjoy significantly improved financial literacy and trust in bank offerings as direct outcomes. The plot thickens when considering how this could redefine banking norms in Egypt’s evolving financial landscape...

Intriguingly, these partnerships may drive the future of banking beyond mere fiscal collaboration towards full-spectrum, relationship-based models of customer interaction. Experts argue this could set a new precedent for how global banking institutions approach local market facilitation. The possibilities sparked by such collaborative frameworks indicate a tide change, not just for banks but for community prosperity at large. As the narrative progresses, the overarching picture of these transformative dynamics is about to get even more fascinating...

As financial technology continues to infiltrate Egypt's banking sectors, the synergy between tech advances and loan accessibility becomes ever more evident. From AI-driven loan approvals to blockchain-based secure transactions, the influx of cutting-edge technology is changing how Egyptians experience and benefit from loans. Instant feedback systems powered by AI algorithms have notably reduced the waiting time for loan approvals, reshaping efficiency norms within the industry. The further possibilities embedded in these tech advancements are equally exhilarating...

For borrowers, embracing financial technology facilitates a direct connection with banks, promoting personalized loan options crafted from predictive data analytics. Customers can receive tailored notifications on better loan refinancing opportunities and optimize their debt management strategies through automated alerts on payment deadlines. This enhanced connectivity signifies a giant leap towards customer-centric financial engagements. Yet this transformation points to a larger disruption in traditional finance soon to be unfolded...

Capitalizing on technology, several banks have also ventured into offering 'digital credit scores', a dynamic reassessment process that responds instantaneously to any changes in borrower profiles. The transparency afforded by these scores engenders a more equitable borrowing ecosystem, where merit-based assessments transcend historically biased credit evaluation methods. With a steady rise in tech-savvy consumers, demand for such innovations is consequently climbing. But lurking beneath are questions regarding long-term implications on conventional banking operations...

This transformative thrust towards tech-enhanced financial services continues to blur conventional boundaries in loan logistics, beckoning numerous opportunities for consumers and institutions alike. As more layers of financial services become imbued with technological prowess, previous limitations appear obsolete, heralding a new era of flexible, efficient banking. This disruption indicates a powerful shift with profound effects on future economic participation policies. The question remains as to how these developments will further materialize in the years to come...

The financial challenges posed by crises, whether global or domestic, have underscored the urgency of adopting smart borrowing strategies in Egypt. During tumultuous periods, the adaptability of one's financial plan becomes crucial to navigating economic uncertainties. Surprisingly, banks have tailored response strategies to help clients maintain financial agility during such times. For instance, offering deferred payment plans that temporarily suspend interest accrual has become prevalent. This flexibility equips borrowers with peace of mind amidst volatile conditions. But there's more to crisis-responsive borrowing that's captivating...

Besides payment deferrals, many banks have begun to implement alternate contractual terms, including floating interest arrangements that adjust in response to economic shifts. Such arrangements can be a lifeline for borrowers seeking relief from inflexible financial obligations. Moreover, banks are adopting policies allowing for renegotiations of loan terms post-crisis, enabling borrowers to recalibrate existing financial agreements. Examining how such provisions impact long-term financial stability raises intriguing possibilities...

Intriguingly, the introduction of risk assessment tools provides borrowers with real-time insights into potential economic threats, allowing proactive measures. With predictive analytics aiding decision-making, borrowers possess critical foreknowledge to navigate downturns effectively. The adoption of such technologies foretells a paradigm shift in crisis management and consumer empowerment, a dynamic that warrants wider consideration. Could these proactive tools redefine consumer resilience during fiscal crises?

Acknowledging the broader context of economic fluctuations, some financial bodies have spearheaded educational initiatives promoting crisis-centric financial literacy. Workshops and digital resources have been made widely available, emphasizing the importance of preemptive financial planning and diligent borrowing practices. Encouragingly, early feedback indicates a growing public awareness of these resources, heralding a new era of informed borrowing. As we delve deeper, the profound implications of such preparedness unfold...

Comprehending interest rate dynamics is fundamental to optimizing borrowing strategies in Egypt. Interest rates, influenced by macroeconomic policies, have fluctuated significantly, underscoring the necessity for borrowers to seize favorable rates opportunistically. This involves staying informed about central bank decisions, which directly influence consumer loan rates. Those leveraging financial advisories for timely rate predictions have reaped substantial savings on their borrowing costs. But this is only a fragment of the larger interest rate narrative...

Interestingly, banks have introduced fixed versus variable rate discussions as part of their client offerings — imparting insights into the benefits and risks associated with each option. Borrowers are now equipped to strategically select the rate type that aligns with their financial stability goals; for instance, opting for fixed rates amidst upward rate trends or variable rates to benefit from any future cuts. This evolving rate strategy indicates a nuanced approach to loan product engagement. The deeper intricacies of this approach reveal untapped wisdom...

Additionally, understanding rate conversion impacts opens up new avenues for borrowers. Long-term loans, for example, may benefit from transitioning between interest models during favorable economic conditions. Banks foster relationships with consumers to advise them on optimal timing and rate conversion advantages, deepening consumer trust and reinforcing cooperative engagement. The strategic maneuvering around rate fluctuations remains crucial for effective borrowing, though further layers exist yet to be explored...

Effectively, interest rates become a tool for optimizing financial health when coupled with robust planning. Borrowers benefit from aligning economic forecasts with personal financial trajectories, unveiling proactive strategies that cement fiscal security. The implications of this strategic alignment are pivotal, signifying a shift towards dynamic borrowing models responsive to changing economic climates. What follows may reshape cultural perceptions of loans and interest management for years to come...

In Egypt’s progressive banking ecosystem, establishing a reliable credit history has emerged as a cornerstone for accessing optimal loan conditions. A strong credit profile not only facilitates lower interest rates but also broadens the spectrum of available loan products. The revelation of how credit scores impact eligibility starkly influences consumer behavior, encouraging prudent fiscal practices. Yet, misconceptions surrounding credit-building persist, necessitating broader education on the significance of strategic credit management...

The importance of actively maintaining a robust credit profile cannot be overstated. Beyond regular repayments, integrating utilities, rent, and subscriptions into the credit reporting framework has proven beneficial, presenting a full spectrum of consumer fiscal responsibility. Banking institutions actively encourage such measures, offering educational tools to demystify credit score dynamics. However, the evolution of credit tracking tools offers further prospects destined to unfold as adaptive banking practices continue evolving...

Nevertheless, external factors such as economic instability can unpredictably influence credit histories. Borrowers are urged to proactively engage in credit monitoring and utilize tools designed to predict the impact of potential economic downturns on credit ratings. Thus, credit management extends beyond mere numerical scores to encompass proactive strategies safeguarding against future uncertainties. As these technologies advance, the visibility of their impact on broader financial behavior warrants closer scrutiny...

Ultimately, prioritizing a healthy credit history represents a gateway to financial resilience. It enables proficiency in capitalizing on loan opportunities as they arise, beneath the aegis of a trustworthy consumer profile. This preparedness forms the foundation of prudent borrowing practices, fostering a culture of informed credit engagement. As these principles gain traction, their broader implications on the economic landscape promise to be transformative. The trajectory of credit history significance continues to unfold in compelling dimensions...

While traditional banks dominate the Egyptian credit market, peer-to-peer (P2P) lending has emerged as a noteworthy alternative, offering distinctive benefits. This growing trend allows borrowers to interact directly with potential lenders via specialized P2P platforms, fostering transparency and competitive interest rates. For many, this community-driven model has reduced reliance on conventional banking channels, augmenting their access to funds. Yet, exploring the P2P ecosystem reveals a host of additional layers...

In practice, the appeal of P2P lending extends beyond mere transactional simplicity. Individuals often report having greater flexibility in negotiating terms and conditions, a luxury typically unavailable within traditional banks. P2P platforms cater predominantly to underserved customers with limited conventional credit access, providing essential financial inclusivity. However, while promising, they necessitate careful consideration regarding trust and credibility metrics. The tension these platforms introduce to established bank norms provokes further reflection...

Interestingly, evolving regulatory frameworks strive to balance P2P's independence with necessary consumer protection protocols. Stricter regulatory oversight seeks to safeguard user interests without stifling the innovation integral to P2P success — an intricate dance that continues to unfold. The alignment of regulatory policies poses intriguing implications for the broader financial market, urging dynamic adaptation to emerging consumer attitudes. But even as policies mature, does the P2P lending model sustain its current momentum?

The reality of P2P lending hinges critically on user safety and the platform's ability to nurture community trust. Innovative technologies like blockchain are envisaged to fortify transactional integrity, ensuring a secure environment for users. As more tech-oriented safety measures ascertain P2P viability, they herald an era of diversified financial provisions — blurring the demarcation between conventional and alternative credit channels. The potential for enhanced financial access in Egypt catalyzed by such models beckons a close examination.

Egyptian governmental policies play a pivotal role in shaping secure borrowing landscapes, as they incentivize banks to extend favorable loan terms while regulating consumer protections. These policies encompass interest ceilings, caps on late fees, and transparency requirements, which protect borrowers from exploitative practices. The framework of these regulations is evolving, reflecting the fluid fiscal dynamics of the region. But there's a deeper interaction between policy and borrowing practices yet to unravel...

Furthermore, governmental initiatives often inadvertently stimulate innovative loan solutions. For instance, securities offered within microfinance institutions receive regulatory backing, engendering trust among potential borrowers. By initiating credit guarantees and risk-sharing programs, the government seeks to incentivize banks to introduce borrower-centric loan products, a progressive step towards nuanced economic engagement. As policymakers refine these frameworks, echoes of their impact on consumer confidence reverberate...

Moreover, targeted government programs focusing on financial literacy are being bolstered to elevate public comprehension of borrowing etiquette and smart financial choices. These initiatives encompass community outreach events, educational subsidies, and partnerships with financial institutions keen on promoting awareness. As more citizens access these resources, the advantages of informed borrowing are expected to solidify within societal norms. Are these efforts sufficient to ensure enduring financial literacy?

This transformative trend towards embedding robust consumer protection mechanisms underscores a fundamental policy shift prioritizing citizens' financial well-being. Initiatives are geared towards long-term economic stability by fostering an informed borrower populace. With policy instruments applied concertedly, the government's scaffolding underpinning Egypt’s loan environment seems poised for enhanced security and equity. Yet the ongoing evolution of these protective measures indicates an unfolding narrative of economic policy development.

Amid Egypt's evolving financial landscape, bridging the gap between borrowers and banks is paramount. By leveraging strategic insights and fostering trust, borrowers can harness newfound financial autonomy. Banks, meanwhile, continue to refocus their offerings to tailor consumer experiences, blurring boundaries toward relationship-driven financial systems. Complementary tools and initiatives spotlighted throughout stream intricate connections defining Egypt's loan dynamics. This exploration promises a path laden with opportunities ripe for engagement.

Inherent within these findings is the imperative to encourage active participation in loan optimization strategies — prompting consumers to seek diverse financial education and advocacy channels. To perpetuate these positive dynamics, sharing this knowledge remains vital, igniting broader understanding and effective borrowing attitudes. Embracing this paradigm shift ensures a sustainable future for Egypt's economic actors, paving the way for proactive and informed financial decisions within secure frameworks. The story of secure borrowing continually evolves, holding promise for a vibrant financial future.