Imagine paying for health insurance that doesn’t cover your needs. This could be the reality of private health insurance in Egypt, where coverage might not match the price tag.

The landscape of health insurance in Egypt is changing rapidly. With new policies and rising costs, understanding what you're paying for is more crucial now than ever before.

Private health insurance in Egypt may seem appealing with its promise of better facilities and quicker service. However, what many don’t know is the vast discrepancy in the services provided compared to what is advertised. Some plans exclude essential treatments, leaving the insured vulnerable. But that’s not even the wildest part…

Despite the growing number of insurance companies, the competition hasn't driven down prices as one might expect. Instead, some premiums have surged over 20% in the last five years, raising questions about affordability and accessibility. Yet, there's a twist that’s about to unfold…

Could the true value of private health insurance in Egypt be something experts completely overlooked? What happens next shocked even the experts…

Many policyholders assume that their insurance covers them for any scenario. In reality, private health insurance policies in Egypt often have a myriad of exclusions buried deep in the fine print. These exclusions can relate to specific treatments or illnesses, leaving many without the coverage they thought they had. This can be distressing, especially when unexpected medical needs arise and the costs fall heavily on the insured. Yet, there’s a hidden catch within these documents…

Some insurance providers have cleverly disguised caps on benefits in their policies. For instance, while your policy might advertise coverage of all surgical procedures, it may only cover them up to a certain limit. Beyond that, out-of-pocket expenses start to soar. The real shocker is that many find out about these limits only during an emergency when it's too late to make alternate arrangements.

Furthermore, pre-existing conditions remain a significant bone of contention. Some insurers in Egypt, while claiming to cover chronic conditions, do so at the expense of very high premiums. It's a delicate balancing act that many are forced to navigate, often without full awareness of their options or rights. But what if I told you there’s a strategy to beat these tricks?

Understanding how to choose the right individual policy that aligns with one's medical needs and financial capabilities can be daunting. Yet, industry insiders hint that knowing one simple fact can turn the tables in your favor. What you read next might change how you see this forever.

Premium or VIP services advertised by insurance companies in Egypt often entice potential clients with promises of luxuries like private hospital rooms and expedited treatment. However, these offerings come with a price that might not always equate to value. Premium does not invariably mean better care. Instead, it usually means higher costs borne by the client, sometimes adding more than 40% to the base cost of insurance. But there's a startling underlayer to this glittering 'premium' promise…

Interestingly, many of these premium services involve additional costs not disclosed upfront. For example, access to specialist consultations or screenings could still incur out-of-pocket expenses if the usage exceeds a predefined limit. Companies might market 'direct billing', yet this often applies to only a limited network of hospitals or clinics. So what truly defines premium? The answers might surprise you.

There’s also the question of hidden fees. Some customers have reported unexpected administrative charges added to their bills, often buried in the small print of policies. This layered complexity not only confuses the insured but also results in higher cumulative costs. Most clients are unaware until they are caught off-guard by hefty bills, realizing their presumed premium package wasn’t all it was cracked up to be.

The idea of exclusive healthcare can appeal to many, yet its actual benefits and pitfalls are less discussed. How can the term 'premium' be reevaluated? The following insights may just flip the narrative on what you thought you knew about high-tier health plans.

International coverage can seem like the golden ticket, offering peace of mind that transcends borders. But in Egypt, choosing between local and international health insurance requires an assessment of different stakes. International plans often claim broader coverage, yet they come with significantly higher prices, sometimes tripling the cost of local plans. Yet, there’s a crucial element many fail to factor in…

Local plans, while seemingly limited to domestic treatments, frequently partner with a vast array of local medical facilities, providing an extensive network at lower costs. Patients may benefit from support more in tune with local practices and systems. For many Egyptians, opting for local plans translates to better cultural and medical affordability. However, there’s an unexpected twist when emergencies arise abroad…

Expats and frequent travelers might find themselves in tricky situations. With international coverage, any surprise trip to a developed country can result in astronomical costs if the insurance only settles bills up to local limits. Yet, an intriguing market shift is blurring these traditional lines. Could there be a middle way that savvy insurance seekers are discovering?

Understanding this evolving choice between local and international plans is vital. How can one maximize benefits while controlling costs effectively? The next sections will uncover possible solutions few know about.

Health insurance premiums in Egypt have been on a noticeable rise, yet few truly understand the mechanics behind this increase. Insurers cite inflation, enhanced medical technology, and the expansion of healthcare facilities as reasons, but there's more beneath the surface. Many companies increment premiums annually, ostensibly for improved coverage, yet these increments may not always translate to better service. But wait, there’s a deeper revelation…

Several insurers base premium adjustments on risk pool evaluations, which often mean those deemed higher risk or older face larger hikes. This is a common industry practice, yet seldom communicated transparently to clients. These systematic adjustments often disadvantage those in vulnerable health groups—adding financial strain to the existing health burden.

Moreover, as new diseases emerge and existing ones evolve, the cost of healthcare escalates. Insurers, in turn, respond by shifting the costs down to policyholders. Yet, rather than providing enhanced services, the primary response has often been more stringent policy clauses and narrower coverage ranges. Nonetheless, there's an irony in these rising premiums one must consider…

The dynamic of rising premiums often discourages early health insurance from a young age, which is ironically the time when insurance might be the most cost-effective. Understanding how to navigate this loop—where premiums appear daunting—is key. Could unlocking this early be the key to affordable health care as you age?

The Egyptian government plays a pivotal yet complicated role in the health insurance landscape. While encouraging private sectors to boost national health standards, regulatory measures to ensure fair practices and affordable premiums remain crucial. But how effectively do these policies safeguard the interests of the insured? There's a surprising twist in this governmental oversight…

Some argue that governmental policies have inadvertently pushed insurers to prioritize profits over patient care, leading to higher premiums and limited service scopes. This market-driven approach has introduced competitive plans but also complex and often confusing insurance terms. Yet, amid these challenges, there's another intriguing aspect that many haven't noticed.

The government's gradual implementation of a comprehensive national health insurance system seeks to reduce dependence on private insurance. Its aim is to offer basic medical services to all. While promising, this initiative faces criticism regarding its pace and the quality of care delivered—creating a contentious dynamic with private insurers.

In navigating this dual-system environment, individuals must carefully evaluate private versus public offerings, considering the overall benefits and adequacy of care. So, what might the future of Egypt's healthcare landscape look like driven by these developments?

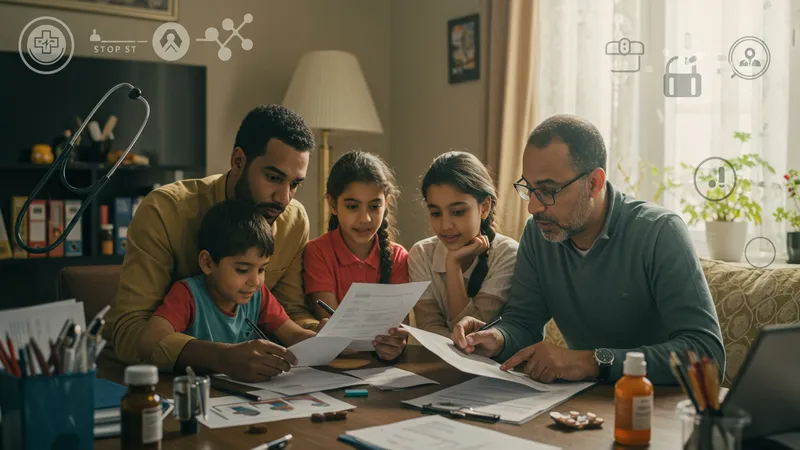

Understanding your health insurance coverage is crucial, yet many in Egypt embark on this journey with limited knowledge. Policies are often packed with jargon and hidden conditions that overwhelm the average customer. This knowledge gap can lead to costly decisions, especially when unexpected health issues arise. Why does this persist, and how can one empower themselves in this complex terrain?

Detailed scrutiny of each policy document is essential. Many sign up without a thorough understanding of the most advantageous aspects of their insurance packages. Missed details regarding deductibles, coverage limits, and medication policies could have significant consequences, frustrating policyholders and limiting their access to care when needed.

It's essential to not just rely on a single source for information. Consulting with multiple insurers can provide a broader understanding of what a fair policy looks like, benchmarking against diverse offerings. It's a task that requires attention yet few seem prepared for its nuances. But delving deeper reveals unexpected opportunities.

Negotiation in the insurance realm is not only possible but necessary. Armed with the right questions and an understanding of one's medical and financial needs, clients can effectively bargain for improved terms. Could this approach fundamentally alter how insurers interact with clients? Exploring this strategy might revolutionize your coverage experience.

When assessing private health insurance in Egypt, one critical question constantly arises: is the return on investment truly worthwhile? While health is invaluable, the outlay on insurance, particularly private plans, needs justification through tangible benefits like access to quality healthcare and peace of mind. But how does one measure this elusive ROI effectively?

The answer often lies in the personal circumstances of the insured—age, health status, and lifestyle choices. Young, healthy individuals might find limited immediate value, yet those planning for long-term health stability see potential worth. However, varying premiums and the unpredictability of life events complicate the picture.

There's also the consideration of opportunity costs. Could funds allocated to expensive premiums be better invested elsewhere, perhaps in preventive health measures or a health savings account? Evaluating these opportunities involves a complex balancing act, weighing potential future benefits against immediate fiscal impacts.

Yet, one must remember that value is not just monetary. Psychological assurance and confidence in one’s health future are immeasurable returns. Delving into the intricacies of this assessment requires more than just figures—it's about aligning coverage with personal priorities. Could this balanced view of ROI be the key to making informed insurance decisions?

Many policyholders in Egypt fall prey to common pitfalls that can make private health insurance less rewarding. Misunderstandings about policy terms, neglecting the fine print, and failure to reassess needs are just a few of these mistakes. But what causes such oversights, and how can they be mitigated effectively?

The overwhelming complexity of insurance jargon scares off many potential policyholders. Too often, buyers get swayed by promotional tactics without critical evaluation of the policy’s suitability. This oversight often leads to less than optimal choices, resulting in insufficient coverage or unnecessary expense.

Another frequent issue arises from complacency. As life evolves, so too must our insurance policies reflect changing needs. Yet, regular policy reviews are shockingly uncommon. Without periodic reassessment, a plan that once served well might fall short, leaving gaps in coverage that are both costly and inconvenient when healthcare demands arise.

In avoiding these common missteps, the key lies in proactive and informed decision-making. Asking the right questions and routinely evaluating coverage can transform seemingly complex insurance processes into manageable, strategic health care planning. How might this awareness change your insurance journey?

Frequently asked questions about private health insurance in Egypt tend to revolve around coverage, costs, and the reliability of service providers. Understanding these elements can demystify the process, yet inquiries often only scratch the surface. What deeper insights can further enhance the informed decision-making process?

One major concern is claiming procedures. Although insurance is meant to safeguard against unpredictable expenses, the timeline for claims can be notoriously slow. Recognizing which insurers have streamlined processes helps avoid long waiting periods that can burden families during medical emergencies.

Another critical aspect is policy portability. With evolving personal circumstances, the ability to switch plans or providers becomes crucial. Knowing your rights regarding policy transitions enables better flexibility and ensures continued coverage without substantial losses or additional charges.

Uncovering these practical insights demands a sophistication beyond reading FAQs; it requires engaging with policies in pragmatic ways. The real question is, how can digesting this information translate into more secure and beneficial health insurance decisions for your future?

Among the abundance of options, choosing the right insurance plan in Egypt can seem daunting. However, insider tips provide pivotal guidance along this path. Learning how the insurance market operates can dispel myths and highlight critical decision points—so, what secrets can help in selecting the ideal insurance plan?

Firstly, evaluating the insurer's network is crucial. A vast and reputable network ensures you have access to quality access without geographical constraints. Even if a plan seems lower in cost, a limited network could prove expensive in case of emergencies, where out-of-network care requires significant additional payments.

Focusing on services such as preventive care and wellness programs can drastically improve the efficacy of health coverage. These inclusions demonstrate an insurer's commitment to long-term health, rather than simply catering to immediate treatments. Spotting providers with this comprehensive focus can make a big difference.

Staying updated on industry trends and customer reviews is imperative. Changes in policies or health trends can provoke shifts in rates or coverage options that require timely adjustments. How might these select strategies reshape your approach to insurance decisions?

Several common misconceptions cloud the perceptions of private health insurance in Egypt, preventing individuals from making the most of their coverage options. These misconceptions create barriers, yet once debunked, enable smarter insurance engagements. What are some prevalent myths, and why are they so misleading?

One significant misconception is that higher premiums guarantee comprehensive coverage. While a costly plan might offer extensive benefits, it isn’t always the case. Some high-cost plans still come with significant gaps or inconvenient exclusions. A critical evaluation of actual policy offerings against needs is more effective than assuming price equates to value.

Another myth is the belief that once an insurance purchase is made, it cannot be altered to accommodate evolving circumstances. Many remain unaware of the flexibility open to policy adjustments or the ability to renegotiate terms annually. This misunderstanding can lead to missed opportunities for better alignment with personal needs.

Finally, the perception that private insurance is a luxury only for the wealthy deters many from exploring viable options. In reality, a range of plans exists catering to various income levels, with creative ways to balance costs against benefits. Coming to grips with these misconceptions can unequivocally change the insurance conversation. How might clarified parameters affect your approach to adequate coverage?

Crafting an insurance policy that fits individual needs starts with understanding each unique coverage requirement. However, many in Egypt feel overwhelmed by the plethora of options without a clear strategy. Tailoring a plan effectively involves several key steps that few know, yet could revolutionize policy ownership. How can policies be more personally advantageous?

Understanding your specific health risks is the first step. Are there chronic conditions or predispositions to illnesses that should be covered? Aligning these needs with appropriate plans ensures that gaps in coverage are minimized, turning insurance into a helpful tool rather than a financial burden.

Comparing plans across different insurers can provide valuable insights into market standards, helping identify which benefits are common versus premium add-ons. This evaluation aids in making informed choices based on factual comparisons rather than emotional biases or uninformed assumptions.

Finally, remaining flexible and ready to adjust as needs evolve maintains optimal coverage. Life changes rapidly, and an insurance plan should adapt accordingly. The ability to foresee these changes and act proactively is a treasure. A personalized approach is not only possible but essential. How might a tailored policy impact your sense of security and financial well-being?

The long-term benefits of comprehending the intricacies of private health insurance in Egypt extend far beyond immediate medical access. This understanding creates a foundation for safeguarding against future uncertainties. So why is delving into detailed insurance knowledge so beneficial over the years?

Health evolves unpredictably but being insured assures that medical care, no matter how advanced, will remain accessible. Understanding your policy terms fully affords you the ability to navigate medical needs with confidence, alleviating potential stressors that accompany sudden health changes.

Financial security also ties into this comprehension. Unexpected expenses can upset financial stability significantly, but with the proper insurance coverage, these potential setbacks transform into manageable adjustments. Therefore, adequate knowledge serves as a buffer against fiscal uncertainty.

The proactive management of health risks through insurance can lead to improved overall well-being. Preventive measures and regular check-ins facilitated by insurance plans contribute immensely to a longer, healthier life. Mastering the sphere of insurance thus promises not just protection but longevity. How might embracing this wisdom alter both your present and future narratives?

The intricate landscape of private health insurance in Egypt is more than just a financial commitment—it's a pivotal element of long-term health strategy. As we delve into this realm, understanding becomes not just advantageous but essential. Sharing what you've learned can empower others to navigate these complex waters confidently and make informed decisions. Bookmark this article and revisit the insights anytime for a refresher. Then, spread the word—because health literacy isn't just personal; it's transformational. The power of knowledge can be your greatest ally.