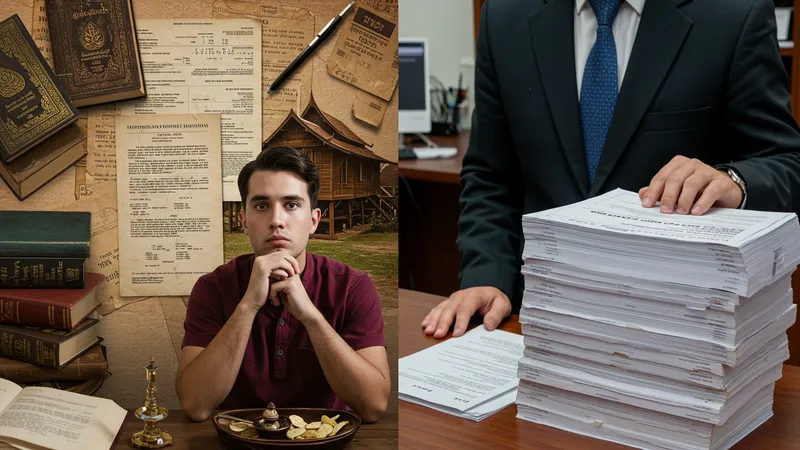

Did you know that investing in property in Thailand can be up to 50% cheaper than in the USA? What's more, this Southeast Asian gem is fast becoming the darling of savvy global investors.

As remote working becomes the norm, people are re-evaluating where and how they live, making property investment across borders more relevant and lucrative than ever.

Here’s a shocker: The average cost to own a condo in central Bangkok is similar to a modest suburban house in the US. This paradox exists due to different economic demands and tourism opportunities. But that’s not even the wildest part…

In the USA, property taxes are a given, but did you know Thailand offers incredible tax exemptions for expatriates? With strategic planning, you could legally minimize tax burdens — a game-changer in wealth-building overseas. But wait till you discover what happens next...

What happens next shocked even the experts: What’s the hidden secret that makes one of these destinations a constant favorite among elite investors? Keep reading to find out...

Bangkok is not just a city of vibrant culture but also a major player on the global real estate stage. With a 9% average annual return on investments, it's attracting investors worldwide. Many overlook just how pivotal tourism plays in this growth. Properties close to hot tourist spots almost guarantee occupancy year-round, which means steady income for investors. But there's more to unravel here...

While the fatherland of smiles offers undeniable charm, the legal restrictions on foreign land ownership are quite stringent. Condos make an attractive alternative as foreign nationals can own up to 49% of the building. Yet, it's not as limiting as it seems. Creative partnerships and long-term leases are turning the tables, allowing more foreign investments than ever. This twist in the narrative could redefine your investment strategy...

Thailand's government offers robust support for real estate developments, attracting numerous foreign corporations. The Eastern Economic Corridor (EEC), for instance, covers everything from infrastructure to investment incentives, making it irresistible to developers and investors alike. But there’s one more twist to this tale that will pique your curiosity...

The market isn't only fueled by foreign buyers. Thai nationals are increasingly investing, causing prices to rise. The domestic demand signals a stable market, beneficial for both short-term and long-term investors. But, before you think you've got it all figured out, there’s a surprising comparison with U.S. real estates coming up next...

The USA remains a giant in the global real estate market, but the rules are different. With tenants' rights heavily protected, rental property investments require a thorough understanding of local laws. On average, maintenance costs can run high, impacting overall yield if not accounted for early on. This complexity can intimidate even seasoned investors...

Despite these challenges, the US market enjoys one of the lowest rental vacancy rates, further bolstered by a diverse economy. Coastal cities, tech hubs, and university towns present low-risk investment opportunities due to constant demand. However, these markets come with high entry-level costs, a sharp contrast to Southeast Asia. There’s a twist to this real estate game, though...

Government support through schemes such as FHA loans and tax deductions make home ownership affordable, giving the impression of ease. But in reality, these benefits often require converts into longer-term financial commitments, which may not always align with investor goals. Just as it seems the US market edges out, there's a factor many fail to consider...

Real estate in the US is driven by a cyclical market influenced by interest rates, housing supply, and economic health. Understanding these cycles is crucial, and missing the cues can result in significant losses. However, the diversity and potential for significant appreciation stand unparalleled. But there’s yet another surprising aspect between these two markets that will certainly amaze you...

Thailand offers compelling tax incentives to foreign investors. Property taxes are relatively low, and there are numerous exemptions available for those investing big. With only a 0.01% transfer fee, the barrier for entry becomes easier. This relief transforms the financial landscape, especially in comparison to the American tax system...

In stark contrast, property investment in the USA comes with inheritable tax responsibilities. While benefiting from deductions and credits, investors in the US face complexities that demand expertise, costing both time and money. Efficient tax planning becomes not just an add-on but a necessity. This makes things intricate, but there’s a thread leading out of this maze...

US investors can globally offset taxes through intricate accounting practices, something potential Thai investors need to evaluate closely. Double Taxation Agreements (DTAs) between countries can help minimize liabilities, a tool few investors prioritize, yet immensely beneficial if practiced judiciously. The strategic use of DTAs can redefine your investment returns...

The decision to invest in one market over the other hinges substantially on these tax impacts. They not only affect returns but also direct your investment strategy. Comprehending these power dynamics can save considerable amounts and direct wiser investments. There’s one aspect of this tax saga that still remains unveiled, which could tip the scales completely...

In Thailand, investing in residential properties often entails choosing between rural charm and urban luxury. Urban areas, mainly Bangkok, possess the allure of city life but come with the competition of ever-escalating property prices. Yet, the rent-to-price ratio tends to be favorable, offering potentially lucrative annual yields to investors. This dynamic presents both challenges and opportunities...

Aligning with western trends, urbanization in Thailand is rising, with more locals migrating to cities in search of employment and better living standards. This influx sustains the high rental demand and keeps occupancy rates promisingly high. Yet, understanding local purchasing power and demands adds the X-factor to uptake profitable deals...

In contrast, the US residential market is notable for its diversity, spanning from single-family homes in quiet suburbs to dynamic city lofts. Property prices are predominantly influenced by location, with houses in tech or educational hubs attracting hefty premiums but also better ROI potential. There's a surprising twist yet to unfold here that may shift your viewpoint...

Both markets show trends towards sustainable and smart homes, increasingly embodying energy efficiency as a value-add. This wave, while new, is quickly gaining momentum among buyers and renters alike. Especially significant for US investors, who see regulatory incentives translate into higher resale values. But wait till you uncover the other, more subtle trends emerging beyond this green facade...

Thailand’s rich cultural tapestry offers much more than tangible investment aspects. The country's deep-rooted traditions and fast-paced modernization present not just a business frontier but a lifestyle change that's equally rewarding. Here, the clash and merge of old and new create a living environment like no other. But there's a unique quirk that investors often miss...

For instance, Thailand's festivals, rich cuisine, and hospitality are world-renowned. For investors sustaining long-term accommodation businesses like Airbnb, this forms a sturdy foundation for guest-benefit and tourism-centered ventures. The nation itself is the selling point, but there's a twist regarding tap into its real potential strategically...

Conversely, the USA offers a compelling cultural tapestry characterized by its multifaceted and diverse population. Urban drift to cultural hubs creates distinct real estate opportunities, each supported by local cultural nuances that shape demand and valuation. Here lies another twist: understanding and leveraging these cultural points can significantly impact investment success...

The question isn't solely about where one can gain quicker monetary returns but also about quality of life influences - education, climate, healthcare. These cultural factors intertwine deeply with the perceived value and desirability of property investments. Curious what the ultimate impact of these considerations is? A final surprising take is just waiting to be uncovered...

The future landscape of property investments in Thailand and the USA hinges heavily on evolving trends, such as technology integration in homes and the emergence of new economic zones. As smart home technology matures, Thailand’s developers are rapidly integrating such features, boosting property value and appeal. But that's only a fraction of the story...

On the American front, the growth of remote work has initiated a renaissance in suburban areas as workers seek out cost-effective, spacious living spaces away from dense urban centers. This movement hints at a gradual shift in property developer interests and consumer needs, but there are niche aspects within this movement to exploit further...

Both countries are seeing a rise in sustainable development practices as environmental awareness grows. Developers are prioritizing green designs, emphasizing energy efficiency and sustainable materials, not just as a branding exercise but a necessary market demand. However, there are clever, less obvious ways these trends could exponentially add value to properties...

Watching these market shifts offers investors a strategic advantage, unlocking hidden potentials early. Predictive analytics and trend forecasting are becoming integral tools, signifying a future where data-driven decisions equate to profits. We're on the verge of revealing a major insight, shedding light on undisclosed burgeoning opportunities...

In Thailand, the property investment safety net includes understanding local regulations and securing trustworthy legal advisors. Theft and fraud incidents are rare, thanks to stringent governmental regulations ensuring investor protection. But it’s advisable to tread carefully, as the nuances of local laws can be complex...

Contrasting this, the USA offers a relatively transparent real estate industry marked by a comprehensive legal framework protecting property rights. However, the importance of thorough due diligence cannot be overemphasized, with hidden liens or disputes often cropping up without warning. There's a twist here that can surprise even the experienced investor...

Corruption in the Thai real estate market is notably minimal, yet no less than a gamble. Thorough understanding and connections with local real estate agents tremendously mitigate risk. In both markets, though, the role of trusted on-the-ground expertise is unmissable, revealing its often-underrated significance…

Market shifts, economic stability, and political climates all influence investment security. The global connection of markets today means that turbulence in one can affect another. Strategic international diversification becomes not just beneficial but necessary. It’s in the upcoming insight that the final piece of this intricate puzzle falls into place...

Deciding where to invest in Thailand involves evaluating more than just price tags. Proximity to critical infrastructures such as schools, hospitals, and transportation hubs often dictate the property's value and marketability, not forgetting the tourist hotspots. The location can unearth hidden advantages for astute investors...

For US investors, lucrative opportunities often lie in up-and-coming areas, where burgeoning tech developments create demand spikes. Often, these aren’t met with adequate housing supply, offering a unique chance for attractive entry prices. Yet, patience and an understanding of potential growth patterns are warranted. There's more complexity to weave into this story...

The concept of “location, location, location” remains ever relevant but requires modern interpretation to factor in global connectivity. In Thailand, emerging zones offer potential unsung prospects, while in the US, gentrifying neighborhoods offer a different kind of reward. The tipping point is understanding the [...]

Strategic location analyses combine with personal investor goals and foresight into developing trends. Both markets reveal unconventional prospects that stretch beyond simple economics. Wait till you see how understanding geographic value creation can transform an investment strategy...

For Thailand, understanding land ownership laws is crucial. Foreign nationals must comprehend co-ownership limitations on property, lest they unintentionally navigate into legal constraints. Expert legal guidance is essential, providing foundational protection against these nuances...

The US market offers wide transparency in property transactions but necessitates verifying property histories and ensuring clear title transfers. Legal loopholes can be costly if overlooked, making thorough consultation crucial in this landscape. But there’s more depth to these seemingly straightforward legal dynamics…

To further confound the legal landscape, cross-national taxations could yield unforeseen challenges. DTAs again come to rescue, though with their intricate stipulations that demand clarity. Legal intricacies can appear as hurdles, or lay foundations for robust investments when navigated expertly...

The approach to legalities in real estate investment requires a strategic sharpness, aided by the right partners. As globalization drives property exchanges, these legal facets highlight the necessity of unique and adaptable strategies. One hidden legal revelation still lies beyond the horizon...

Understanding legal nuances is the guardrail that protects against erroneous investments. Both Thailand and the USA have complexities that could make or break deals. As you lean forward to grasp the full spectrum of investment potential, there’s yet one unseen factor to highlight...

Real estate often holds an emotional value, transcending mere financial returns. In Thailand, the charm offered by serene landscapes and warm communities signifies more than a mere investment. For expats and retirees, this emotional quotient becomes a crucial investment determinant, yet there’s an element many miss...

As lively and diverse as the US is, it offers a sense of security inherent in established markets. This status provides not just confidence but emotional assurance in asset stability and potential growth. Both have their emotional tenets, that could lead to hasty decisions arising from perceived value…

The importance of emotional undercurrents becomes apparent when market volatility arises. Here, grounded investments require balancing financial foresight with these associated emotional or lifestyle aspirations. In either nation, recognizing this dimension is key...

The symbiosis of addressing emotion with practicality results in successfully sustaining long-term investments. With economic ebbs and flows, these emotional inclinations may well emerge as powerful guiding instincts. This subtle, yet paramount consideration holds a surprising influence on the ultimate winning strategy...

As we delve deeper, imagine this emotional paradigm combined with astute financial strategies. A transformative perspective worth uncovering lies in wait...

Moving beyond properties, the overarching question leans towards lifestyle suitability. Thailand beckons with its affordable cost of living, tranquil landscapes, and rich cultural experiences, creating an unparalleled quality of life. But can lifestyle alone substantiates the investment's worth...

In contrast, settling in the USA offers a business-friendly environment with access to renowned institutions, innovations, and diverse opportunities. The multifaceted lifestyle of the US anchors an economically vibrant yet personally fulfilling undertaking. But there's a tweak to consider...

Life in Thailand might appear slow-paced, yet the bustling cityscapes give a boost of adrenaline that complements the peaceful countryside. This duality aligns well with various life stages and career aspirations, posing as more than just an economic decision...

The US with its melting pot culture offers essential freedom and diversity influencing dynamic lifestyle choices. The country's geographical vastness ensures that it accommodates every lifestyle and preference - from the adventurous to the secure. From this insight, lies an aspect that redefines borders and markets...

It's more than opportunities; it's about finding a lifestyle that encourages growth and happiness. Given the unique offerings of each country, exploring this facet becomes vital. Unveil how this lifestyle dialogue could sway prospects unknowingly...

With looming sheen captured by Thailand, emerging markets within its borders are yet to garner adequate attention. As developmental projects arise, these locations hold vast untapped potential. Imagine discovering a goldmine before anyone else...

The rise of secondary cities within the US suggests a similar opportunity, presenting cost-effective entry points for those ready to explore the unexplored. Scenarios envision envisioning the next epicenter of growth hold surprisingly lucrative prospects...

These emerging spaces encapsulate the very essence of what real estate investment could stand for - visionary advancement. From thoughtful urban planning to harnessing rural charm, the elements combine to promise unexpected rewards...

The possibility of unveiling undiscovered markets highlights the endless potential within both nations. This revelation expects creativity and keen perception in an investor's arsenal. Delving deeper into this can reinvent traditional strategies...

Despite competition, unexplored regions reflect an investor's paradise, where foresight and vision triumph. The transformation in paradigm that awaits discovery holds promise beyond limits...

So, which market outshines the other, Thailand or the USA? Each holds its charm and challenges, capable of fulfilling different investor profiles. Thailand offers potential income with its tourism-friendly environment, affordable real estate, and cultural wealth. Conversely, the USA ensures a robust legal framework, infrastructural advantages, and renowned opportunities for both fiscal growth and lifestyle enhancement. But the verdict lies in aligning personal goals with market insights...

It comes down to crafting a strategy that harmonizes financial objectives with emotional and lifestyle aspirations. Embrace the challenge of understanding dynamic real estate principles and forging avenues across borders. Your optimal investment decision may very well lie beyond current comprehension. Which path will ultimately secure your future? Time to take action, align your visions, and potentially share insights with fellow investors, embarking on a global property quest that redefines expectations.